Shipping Your Car to Portugal: A Complete Guide to Costs and Considerations

Dreaming of sunny beaches, historic cities, and delicious pastéis de nata in Portugal? If you’re planning a big move or an extended stay, you might be wondering if you should bring your beloved car along for the ride. Shipping a car overseas can seem like a huge puzzle, filled with hidden fees, tricky paperwork, and a lot of unknowns. But don’t worry! This guide will break down everything you need to know about the cost of shipping a car to Portugal, helping you make an informed decision and navigate the process with confidence.

We’ll cover the main costs, different shipping options, important rules, and tips to save money. By the end, you’ll have a clear picture of what to expect and whether bringing your car is the right choice for your Portuguese adventure. 🇵🇹🚗

Key Takeaways

- Total Cost Varies Greatly: Shipping a car to Portugal can range from €1,500 to €6,000+, depending on factors like your car’s size, shipping method, origin country, and taxes.

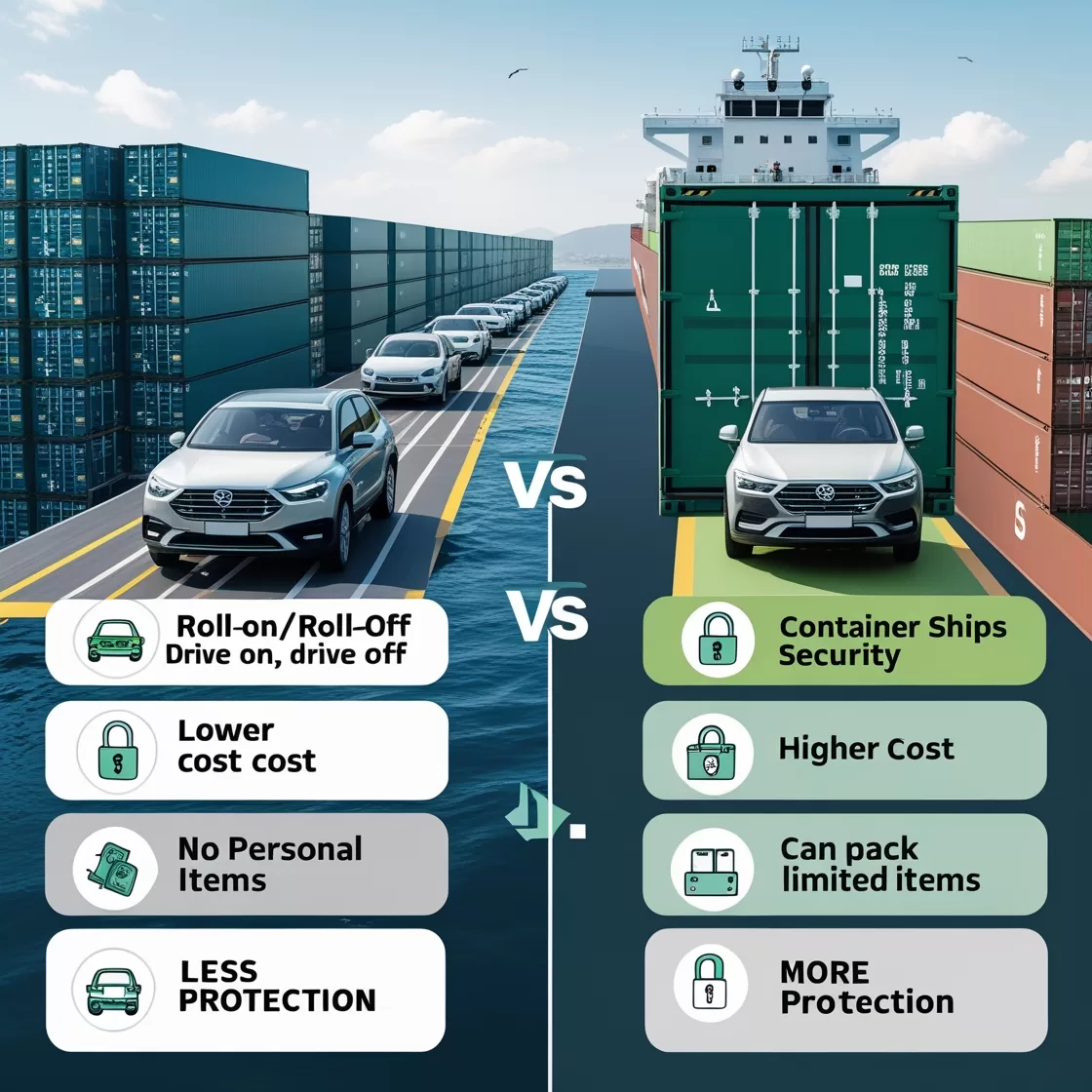

- Shipping Methods Matter: Roll-on/Roll-off (RoRo) is usually cheaper for standard vehicles, while container shipping offers more security and flexibility but costs more.

- Taxes and Duties are Significant: Be prepared for Value Added Tax (VAT) and Vehicle Tax (ISV). However, you might be exempt from ISV if you’re moving your permanent residence.

- Paperwork is Crucial: Gathering all necessary documents for customs and registration is a complex but vital step to avoid delays and extra costs.

- Consider Alternatives: Sometimes, buying a car in Portugal or relying on public transport might be more cost-effective and less hassle than shipping your current vehicle.

Why Ship Your Car to Portugal? Weighing the Pros and Cons

Bringing your car to a new country like Portugal is a big decision. Let’s look at why you might want to, and why you might think twice.

The Upsides 👍

- Familiarity and Comfort: Driving a car you already know can make getting around a new place much easier and more comfortable. No need to learn a new car’s quirks!

- Specific Needs: If you have a specific type of car (like a larger SUV for family, a classic car, or one with special modifications), it might be hard to find a similar one in Portugal.

- Known History: You know your car’s maintenance history, which can offer peace of mind compared to buying a used car with an unknown past.

- Long-Term Savings: If you plan to stay in Portugal for many years, the upfront cost of shipping might be less than buying a new car there, especially if you qualify for tax exemptions.

The Downsides 👎

- High Costs: As you’ll see, shipping is expensive. The total cost can add up quickly with shipping fees, taxes, and registration.

- Complex Process: There’s a lot of paperwork, customs rules, and different steps involved. It can be time-consuming and stressful.

- Potential Damage: While rare, there’s always a small risk of your car getting damaged during transit.

- Driving Conditions: Portugal has narrow, winding roads in many areas, especially older cities. A very large car might be difficult to navigate and park.

- Maintenance: Finding parts or mechanics for non-European car brands might be harder or more expensive.

🗣️ “Moving abroad is exciting, but don’t let the details overwhelm you! Planning your car’s journey early can save you a lot of headaches later.”

What Factors Influence the Cost of Shipping a Car to Portugal?

The final bill for shipping your car isn’t just one number. Many things come together to create the total cost. Understanding these factors will help you estimate your expenses.

1. Origin and Destination 🌍

The further your car travels, the more it will cost. Shipping from the United States or Canada will be more expensive than shipping from another European country. Major ports like Lisbon or Porto are typically cheaper destinations than smaller, less-frequented ones.

2. Shipping Method 🚢

This is one of the biggest cost drivers. You generally have two main choices:

- Roll-on/Roll-off (RoRo): Your car is driven onto a specialized ship and secured.

- Container Shipping: Your car is placed inside a metal container. This can be shared with other vehicles (shared container) or you can have a dedicated container just for your car.

We’ll dive deeper into these methods shortly.

3. Vehicle Type and Size 📏

Larger and heavier vehicles (SUVs, trucks, vans) will cost more to ship than smaller cars (sedans, compacts) because they take up more space and weight on the vessel. Luxury or classic cars might also incur higher insurance costs.

4. Insurance 🛡️

While shipping companies usually offer basic insurance, it might only cover major damage or total loss. You might want to purchase additional marine insurance for broader coverage, protecting your car against scratches, dents, or other minor damages. This is an extra cost but offers peace of mind.

5. Port Charges and Fees ⚓

When your car arrives at the port in Portugal, there will be charges for unloading, handling, and storing it temporarily. These are called terminal handling charges (THC) or port fees. They can vary depending on the port and the local regulations.

6. Customs Duties and Taxes 💸

This is where costs can really add up! Portugal, as part of the European Union (EU), has specific rules for importing vehicles. The main taxes you’ll face are:

- Value Added Tax (VAT): A consumption tax applied to most goods and services. For imported cars, it’s usually 23% of the car’s value (including shipping costs and customs duties).

- Impuesto Sobre Veículos (ISV) – Vehicle Tax: This is a significant tax based on the car’s engine size, CO2 emissions, and age. Newer, larger, and less eco-friendly cars will pay more.

- Imposto Único de Circulação (IUC) – Annual Road Tax: Once your car is registered in Portugal, you’ll pay this yearly tax, similar to vehicle excise duty in other countries.

💡 Good News for Expats! If you are moving your permanent residence to Portugal from outside the EU/EEA, you might be exempt from ISV and VAT on your vehicle. This is a huge saving! To qualify, you usually need to have owned the car for at least 6-12 months before moving, have lived outside Portugal for at least 12 months, and import the car within a specific timeframe (e.g., 6-12 months) of establishing residency. Always check the latest rules with Portuguese customs (Autoridade Tributária e Aduaneira) or a reputable shipping agent.

7. Vehicle Homologation and Registration 📝

Once your car clears customs, it needs to be made legal for Portuguese roads. This involves:

- Homologation: Ensuring your car meets European and Portuguese safety and environmental standards. This might require modifications or special inspections, especially for non-EU vehicles.

- Technical Inspection (IPO): A mandatory roadworthiness test.

- Registration: Getting Portuguese license plates and a Documento Único Automóvel (DUA), which is the vehicle’s unique registration document.

These steps involve fees for inspections, administrative costs, and the registration plates themselves.

8. Agent Fees and Services 💼

Many people choose to use a shipping broker or freight forwarder to handle the complex process. They can manage logistics, customs clearance, and even help with registration. Their fees are an additional cost, but their expertise can save you time, stress, and potential mistakes.

Shipping Methods Explained: RoRo vs. Container

Choosing the right shipping method is key to balancing cost, speed, and security.

1. Roll-on/Roll-off (RoRo) 🚢

How it Works: Your car is driven onto a large vessel specifically designed to carry vehicles, much like a multi-story parking garage. It’s then secured for the journey. When it arrives, it’s simply driven off.

Pros:

- Most Economical: Usually the cheapest option, especially for standard-sized cars.

- Simplicity: Less handling involved, as cars are driven directly on and off.

- Frequent Sailings: RoRo services typically have regular schedules between major ports.

Cons:

- Less Protection: Your car is exposed to the elements inside the ship (though generally well-protected from severe weather).

- No Personal Items: You cannot pack personal belongings inside the car. The car must be empty except for factory-installed items.

- Limited Ports: Available only at major vehicle shipping ports.

- Fixed Schedule: Less flexible with departure/arrival dates.

Typical Cost Range (from North America): €1,000 – €2,500 (for a standard sedan)

2. Container Shipping 📦

How it Works: Your car is loaded into a steel shipping container.

a. Shared Container (LCL – Less than Container Load)

How it Works: Your car shares a 20-foot or 40-foot container with one or more other vehicles. This is a popular option for those who want container security without the full cost.

Pros:

- More Protection: Your car is fully enclosed and protected from the elements and potential minor damage during transit.

- Can Pack Items: Some companies allow you to pack a limited amount of personal items inside the car (check with your shipper for rules and insurance implications).

- More Flexible Routes: Containers can often be shipped to a wider range of ports.

Cons:

- Waiting for Consolidation: You might have to wait for the container to be filled with other cars before it ships, which can add to transit time.

- Slightly More Expensive: Costs more than RoRo.

Typical Cost Range (from North America): €2,000 – €4,000 (for a standard sedan)

b. Dedicated Container (FCL – Full Container Load)

How it Works: You get an entire 20-foot or 40-foot container just for your car (or multiple cars if you have a very large vehicle or are shipping more than one).

Pros:

- Maximum Protection: Your car is completely isolated and secure.

- Fastest Transit: No waiting for other cars; the container ships as soon as it’s loaded.

- Full Control: You decide exactly what goes into the container (within legal limits).

- Ideal for Valuables: Recommended for classic, luxury, or high-value vehicles.

Cons:

- Most Expensive: Significantly higher cost than other methods.

Typical Cost Range (from North America): €3,000 – €6,000+ (for a standard sedan)

Step-by-Step Process of Shipping Your Car to Portugal

Shipping a car is a multi-step journey. Here’s a general overview of what to expect:

Step 1: Research and Get Quotes 🧐

Start early! Contact several international car shipping companies. Get detailed quotes that include:

- Base shipping cost

- Port charges (origin and destination)

- Customs clearance fees

- Insurance options

- Estimated transit time

- Any additional services (e.g., door-to-port, door-to-door).

Compare not just prices, but also services, reputation, and customer reviews.

Step 2: Gather Your Documents 📂

This is perhaps the most critical part. Missing or incorrect documents can cause major delays and extra costs. You’ll need:

- Proof of Ownership: Original vehicle title or registration.

- Bill of Sale/Purchase Invoice: If recently bought.

- Passport/ID: For the car owner.

- Portuguese Tax Identification Number (NIF): Essential for any financial transaction in Portugal. Learn more about getting your NIF and other vital steps for moving to Portugal.

- Proof of Residence in Portugal: Rental agreement, property deed, utility bills.

- Proof of Residence Abroad: To show you’ve lived outside Portugal (for ISV exemption).

- Vehicle Registration Certificate (Certificado de Matrícula) from your home country.

- Certificate of Conformity (CoC): This document proves your car meets EU standards. If your car doesn’t have one (common for non-EU cars), you’ll need to get one or apply for individual homologation in Portugal.

- Power of Attorney: If an agent is handling customs for you.

- Declaration of Value: For customs purposes.

📝 Tip: Make multiple copies of all documents and keep them organized. It’s wise to have both physical and digital copies.

Step 3: Prepare Your Vehicle 🛠️

Before shipping, your car needs to be ready:

- Cleanliness: Wash the car thoroughly, inside and out. Customs officials will inspect it.

- Fuel Level: Most shippers require the fuel tank to be no more than a quarter full.

- Remove Personal Items: For RoRo, the car must be empty. For containers, check with your shipper about what can be left inside. Remove any valuables, loose items, and non-factory installed accessories.

- Disconnect Alarms: Ensure car alarms are off to prevent battery drainage during transit.

- Check for Leaks: Address any fluid leaks to avoid issues during shipping.

- Note Damage: Take photos and videos of your car from all angles before shipping to document its condition.

Step 4: Shipping and Tracking 🚢

Once your car is handed over to the shipping company, you’ll receive a Bill of Lading. This is your receipt and contract. It will contain tracking information, allowing you to monitor your car’s journey.

Step 5: Customs Clearance in Portugal 🛂

Upon arrival at a Portuguese port (like Lisbon or Sines), your car will go through customs. This involves:

- Submitting Documents: All the paperwork you gathered.

- Paying Duties and Taxes: Unless you qualify for an ISV/VAT exemption.

- Inspection: Customs officials may inspect the vehicle.

This process can take several days or even weeks. This is where a good local agent can be invaluable.

Step 6: Vehicle Inspection and Registration in Portugal 🇵🇹

After customs, the final steps to make your car road-legal in Portugal are:

- Technical Inspection (IPO): Your car will undergo a mandatory technical inspection at an approved center. This ensures it meets Portuguese safety and environmental standards.

- Homologation (if needed): If your car doesn’t have an EU Certificate of Conformity, it will need individual approval from the IMT (Institute for Mobility and Land Transport). This can involve specific tests and potentially modifications.

- Obtain Portuguese License Plates: Once homologated and passed inspection, you can apply for Portuguese registration plates.

- Pay Annual Road Tax (IUC): This tax is due yearly.

- Get Portuguese Insurance: Your foreign insurance won’t be valid in Portugal long-term.

- Obtain Documento Único Automóvel (DUA): This is your car’s new Portuguese registration document.

This entire registration process can be lengthy, taking anywhere from a few weeks to several months.

Estimated Costs Breakdown for Shipping a Car to Portugal

Here’s a general idea of the costs involved. Please remember these are estimates and can vary widely based on your specific situation, the shipping company, and market conditions.

| Cost Category | Estimated Range (EUR) | Notes |

|---|---|---|

| Base Shipping Fee | ||

| – Roll-on/Roll-off (RoRo) | €1,000 – €2,500 | For standard sedans from North America. |

| – Shared Container | €2,000 – €4,000 | For standard sedans from North America. |

| – Dedicated Container | €3,000 – €6,000+ | For standard sedans from North America. Costs increase significantly for larger vehicles or luxury/classic cars. |

| Origin/Destination Port Charges | €200 – €700 (each end) | Terminal handling, loading/unloading, local transport to port. |

| Marine Insurance | 1.5% – 2.5% of car’s value | Optional, but highly recommended. Covers potential damage during transit. |

| Customs Duties & Taxes | BIGGEST VARIABLE! | |

| – VAT (Value Added Tax) | 23% of car’s value + shipping + duties | Applied to the total value. Potentially exempt for permanent residents moving from outside EU/EEA. |

| – ISV (Vehicle Tax) | €0 – €10,000+ | Based on engine size, CO2 emissions, and age. Can be very high for newer, larger, and higher-emission vehicles. Potentially exempt for permanent residents moving from outside EU/EEA. |

| Homologation & Inspection | €200 – €1,000+ | Fees for Certificate of Conformity (CoC) or individual homologation process, technical inspection (IPO). Can be higher if modifications are needed. |

| Registration Fees | €50 – €200 | For new Portuguese license plates and the Documento Único Automóvel (DUA). |

| Annual Road Tax (IUC) | €30 – €500+ (annually) | Ongoing cost after registration, depends on engine size, CO2, and fuel type. |

| Shipping Agent/Broker Fees | €300 – €1,000+ | For handling logistics, customs paperwork, and coordination. Highly recommended for complex moves. |

| Total Estimated Cost (Excluding ISV/VAT Exemption) | €4,000 – €15,000+ (highly variable) | This range is vast because the ISV and VAT can be thousands of euros. If you qualify for exemption, the cost drops significantly. |

| Total Estimated Cost (With ISV/VAT Exemption) | €1,500 – €6,000 (highly variable) | This range primarily covers shipping, port fees, agent fees, homologation, and registration. Still depends on vehicle type and shipping method. |

Smart Tips to Save Money and Avoid Headaches 💰

Shipping your car doesn’t have to break the bank or your spirit. Here are some ways to keep costs down and the process smooth:

- Compare Multiple Quotes: Don’t just go with the first company you find. Get at least 3-5 detailed quotes from different reputable international car shipping companies. Look at their services, insurance options, and customer reviews.

- Understand Tax Exemptions: This is the biggest potential saving! If you’re moving to Portugal as a permanent resident, research the ISV and VAT exemptions thoroughly. Ensure you meet all the criteria and have the necessary proof. It’s often worth consulting with a local Portuguese customs agent or lawyer.

- Consider RoRo: If your car is a standard vehicle and you don’t need to ship personal items inside, RoRo is usually the most budget-friendly shipping method.

- Do Some DIY: If you’re comfortable with paperwork and don’t mind navigating bureaucracy, you might save on agent fees by handling parts of the customs and registration process yourself. However, for most, an agent is a worthwhile investment.

- Clean Out Your Car: Remove all personal belongings. This prevents potential issues with customs and reduces the risk of items being lost or stolen. For RoRo, it’s mandatory.

- Check Vehicle Standards: Before shipping, research whether your car meets EU and Portuguese standards. If it needs major modifications for homologation, the cost might outweigh the benefit of shipping. Some older or very specific models might be very difficult or impossible to register.

- Know the Portuguese Driving Rules: Before you hit the road, make sure you’re familiar with local traffic laws, speed limits, and road signs. Portugal drives on the right, and roundabouts are very common!

📢 “Navigating Portuguese bureaucracy can be challenging. Don’t hesitate to seek professional help for customs and registration; it’s an investment in peace of mind!”

Alternatives to Shipping Your Car 🚶♀️🚌🚗

After looking at all the costs and complexities, you might decide that shipping your car isn’t the best option. Here are some alternatives:

- Buy a Car in Portugal: This is often the simplest solution. You can buy new or used. Used cars in Portugal can be more expensive than in some other countries, but you avoid all shipping and import hassles. You’ll still need a NIF and proof of residence.

- Lease or Rent a Car: For shorter stays or if you prefer not to own a car, leasing or long-term rentals are an option. This offers flexibility and avoids maintenance costs.

- Rely on Public Transport: Portugal has a good public transport network, especially in major cities like Lisbon and Porto. Buses, trams, and trains can get you to most places. For example, finding a place to rent a studio in Lisbon often means you’re well-connected by public transport.

- Ride-Sharing/Taxis: Services like Uber are available in major urban areas.

- Cycling/Walking: Especially in smaller towns or for short distances, walking or cycling can be a great way to explore and stay active. You can even explore the vibes of Madeira, Portugal on foot or using local transport!

Important Regulations and Requirements in Portugal 🚦

Beyond the costs, understanding the legal landscape is crucial.

- IMT (Instituto da Mobilidade e dos Transportes): This is the main government body in Portugal responsible for vehicle registration, driving licenses, and transport matters. You’ll interact with them for homologation and registration.

- ISV Exemption (Benefício Fiscal): We’ve mentioned this, but it’s worth stressing its importance. If you are transferring your normal residence from outside the EU/EEA to Portugal, you generally have 12 months from the date of establishing residency to import your car and apply for this exemption. The vehicle must have been owned and used by you for at least 6 months in your previous country.

- Driving License: If you have a non-EU driving license, you’ll need to exchange it for a Portuguese one within a certain period (usually 2 years) after obtaining residency.

- Vehicle Insurance: It is mandatory to have third-party liability insurance for any car driven in Portugal.

For more detailed information on moving to Portugal, including visa and immigration processes, check out the resources available on Fincou. Don’t forget to review our privacy policy for data handling practices.

Conclusion

Shipping your car to Portugal is a significant undertaking, but it’s certainly doable if you’re prepared. The cost of shipping a car to Portugal can range from a few thousand euros to well over ten thousand, largely depending on whether you qualify for tax exemptions and your chosen shipping method.

The key takeaways are clear: do your homework, gather all your documents meticulously, and budget generously for all potential fees, especially taxes and homologation. While the process can be complex, having your familiar vehicle can offer a sense of comfort and independence in your new Portuguese life. Weigh the pros and cons carefully, consider the alternatives, and make the choice that best suits your needs and budget. Boa sorte! (Good luck!)

Interactive HTML Element: Portugal Car Shipping Cost Estimator

This simple calculator helps you get a rough estimate of the costs involved in shipping a car to Portugal. Please note this is an estimation tool and actual costs may vary significantly based on specific shipping companies, vehicle details, current market rates, and exact tax calculations. It does not account for all possible fees or specific tax exemptions.